From Governor of the Bank of England to net-zero hero: why we should all be backing Mark Carney’s mission to build a sustainable world economy

(Image courtesy of Getty Images)

No longer in the employ of the UK civil service, Mark Carney is the UN special envoy for climate and finance but also leads ESG investment for Brookfield Asset Management (the world’s second largest investor in climate-friendly businesses).

One of many prominent business figures campaigning hard to explain the crucial role of finance in turning the tide against climate change, Mr Carney has made it his mission to mobilise world leaders, policy makers and businesses into taking decisive action.

Speaking at the Talking Business Asia: The Climate Change Challenge, he said:

“One of the biggest issues is you cannot self-isolate from climate. That is not an option. We cannot retreat in and wait out climate change, it will just get worse.”

Why the finance sector is so crucial in the fight against climate change

Money makes the world go round, but successful economies depend on stability and resilience where investment outcomes are largely predictable.

We rely on the natural world to provide this consistency, yet since the industrial revolution we have continued to invest in practices that are overtly detrimental to the environment which has resulted in destabilising the very thing we depend upon most for our future security: the health of our planet.

Floods, forest fires, hurricanes and other manifestations of climate change are all symptomatic of the natural world in crisis; symptoms that cannot be treated without consciously committing to a shift in thinking and a more responsible global approach to investment.

The growth of conscious capitalism

Socially Responsible Investing (SRI) is not a new concept, it first started back in the 1960s when investors chose to exclude stocks such as tobacco from their investment portfolios.

But in recent decades the practice of SRI has evolved to incorporate a wider remit under the umbrella term Environmental, Social and (Corporate) Governance (ESG).

ESG investing had already started to significantly gain ground pre-pandemic as investors and businesses started to realise the merits of conscious capitalism. However, ESG investing has gathered serious momentum over the last year with more businesses seeing the value of putting the planet and people at the heart of good business practice.

According to global provider of financial market data and infrastructure Refinitiv ‘2020 saw record inflows into ESG funds, and this trend will only keep growing.’

Why ESG should be at the heart of every business to reach net-zero by 2050

Since March 1994 when the United Nations Framework Climate Change (UNFCCC) first came into force, we have seen their mission to address climate change evolve to encompass a wider range of goals and greater transparency and expand to offer greater support for developing countries.

One hundred and ninety countries (including the US who recently rejoined under Biden’s presidency) have now ratified the Paris Agreement from COP21, which commits to making the net-zero transition in the second part of the 21st century.

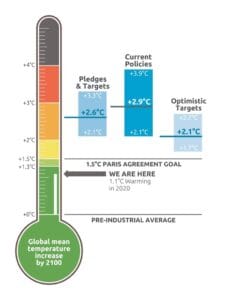

But since the 2015 Paris Agreement and despite the pandemic, global emissions have continued to rise giving widespread cause for concern at the escalating urgency of the situation.

The global effort is still falling short and the threat this poses is growing, not diminishing.

(Image courtesy of Mark Carney on LinkedIn)

Is there still time to turn the tide?

Whilst progress has been faltering, there is still cause for cautious optimism as more international governments have come to realise that time is running out and tougher action must be taken.

In June 2019, the UK became the first major economy in the world to pass laws to bring all greenhouse gas emissions to net zero by 2050. Since then, ‘the European Union, South Africa, Japan, South Korea and Canada have all set targets of reaching net-zero emissions by 2050… And China, in perhaps the biggest climate news of 2020, announced plans to become “climate neutral” by 2060.’

The latest convert to the net-zero cause is of course the United States who, according to Martin Wilder, former chair of the Australian Renewable Energy Agency and founding partner of the climate advisory firm Pollination, have now announced ‘the most comprehensive plan by any government ever on climate change’.

ESG reporting – A step in the right direction

Experience tells us that transparency is key to accountability, so the introduction of new mandatory disclosure regulations in the EU for ESG reporting for certain financial service sector firms from March 2021 is a welcome move that promises to help push reaching net-zero for carbon emissions to the top of the agenda in more boardrooms within the EU.

In the UK, the Financial Conduct Authority (FCA) have chosen to prioritise ESG reporting and ‘disclosures will be mandatory across the UK economy by 2025, with listed companies expected to be required to disclose for years beginning on/after 1 January 2021.’

The FCA’s new regulations which mandate ESG reporting also standardise the metrics for how ESG is measured, meaning that in the UK at least, ESG performance will become mission-critical for all listed companies and will be a key point of comparison going forwards.

But whilst this is encouraging, that still leaves many other countries which have yet to implement mandatory ESG disclosure regulations, including the US – though the current Biden administration is highly likely to take action to close this gap and corporations like Apple are actively calling for mandatory climate reporting.

Unfortunately, as Mr Carney is well aware, until governments and leadership teams of every continent, country, corporation and limited company fully align their efforts and commitments to the net-zero cause, we all remain exposed to the dangers of climate change.

What’s next on the roadmap to net zero?

It may have been delayed due to the global pandemic, but the 26th annual Conference of the Parties(COP26) will take place in Glasgow later this year.

With so much now riding on its success, we must all hope that COP26 marks a seminal moment in the history of our planet. A moment where heads of state, climate experts and negotiators will all finally define a viable action plan to accelerate achieving the goals set out in the Paris Agreement, including a fail-safe roadmap to reaching net-zero that policy makers, investors and businesses can all get behind.

What does a sharper focus on sustainable economic growth mean for the job market?

The last year has been particularly tough for businesses across the world as they have struggled to counter the disruption caused by the global pandemic. But building back with a green agenda means improving our prospects for a brighter, better future for everyone.

Cleaner, greener industries and a more defined and compelling focus on ESG will mean new opportunities for innovation and new opportunities for sustainable employment across the green economy. In other words, growth: with the global demand for green skills growing in line with the growth of the global green economy.

The global energy sector is already seeing the benefits of switching focus to sustainable practices and last year’s ‘seventh edition of Renewable Energy and Jobs – Annual Review shows that jobs in the sector reached 11.5 million globally last year, led by solar PV with some 3.8 million jobs, or a third of the total.’

And inevitably improvements in the energy sector have the potential to feed improvements across the supply chain of every sector across the world.

The picture in the UK is already looking more positive. In November 2020, the UK government announced its 10-point plan for a Green Industrial Revolution which will create and support 250,000 jobs across clean energy, transport, nature and innovative technologies.

ESG – the importance of social impact as well as environmental impact

Mr Carney is absolutely right to say that we must prioritise responsible investment to build a sustainable future. Economic success based purely on profit will count for nothing in a world that cannot support human life, or any life for that matter. But ESG is not just about ensuring the business community meet environmental goals, it is also about adopting a more ethical and sustainable approach to people, especially those employed or affected by a company’s actions.

The S in ESG stands for Social and this means as well as making businesses accountable for their environmental impact, we must also ensure they have a positive social impact.

There are many ways to measure social impact, but one key aspect of ESG going forward will be how companies build diversity, equity and inclusion into their plans to ensure young people from all backgrounds can access opportunities in order to improve social mobility.

Meeting ESG targets – how we can support businesses

As tighter regulations surrounding ESG reporting take effect in the UK, we can help employers meet their social impact targets now and help them build a future workforce aligned to their net-zero goals.

We launched our inaugural Green Skills Week in April 2021 to help educate young people on the importance of the natural world to our economy and to highlight the many opportunities that exist for building a future founded on cleaner, greener principles.

Through this green-skills focused campaign, we have already hosted 5,000 virtual work experience placements with companies like Sky, Man Group, Anglian Water, Morgan Sindall, National Grid, and many more. We have also hosted more than 80 expert speakers from a wide range of industries who have shared valuable insights on the green economy with thousands of young people throughout the UK.

The call to action for employers and educators

In Mark Carney’s own words:

‘…the catastrophic impacts of climate change will largely fall on future generations… the sooner we act, the less costly it will be; for an issue that can only be solved in the present, we have to value the future.’

We need your continued support as employers and educators to ensure that now and going forwards every young person in the UK understands the importance of getting green-skills ready.

Employers, find out how you can host green-skills work experience.

Educators, spread the word: offer work experience to your students and sign up to host a Vtalk or find out how to join upcoming talks.

You might also like to view the WWF’s 8-minute video featuring Mark Carney: Our Planet: Too big to fail